Saving vs investing

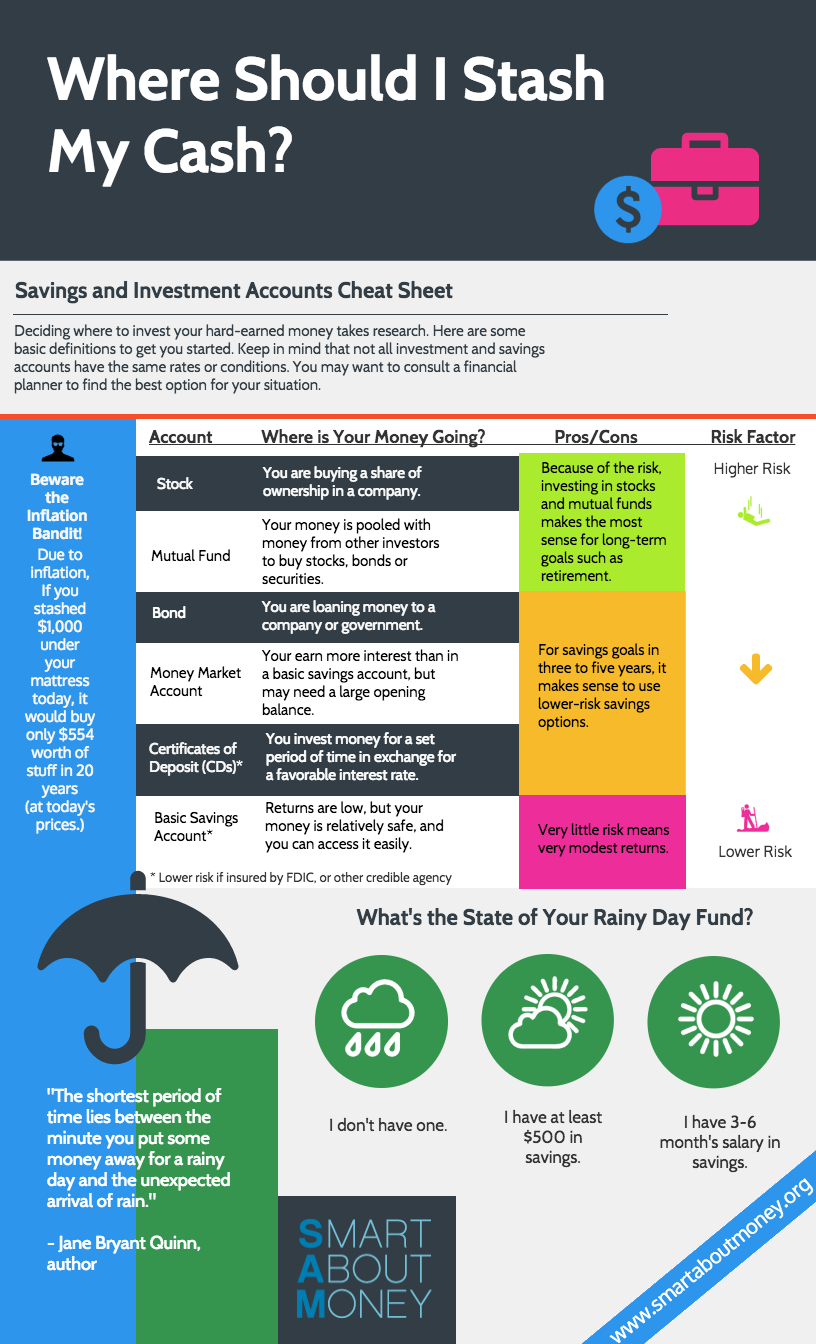

Saving and investing are great uses for any extra income you may acquire. They are very different and each have their own pros and cons. It is up to you to decide the best use for your extra income depending on your time frame, financial goals, and how adverse you are to risk.

Savings accounts or savings bonds offer the least amount of risk. They are easy to use, don't fluctuate in value, and have a set rate making them the safest option. However, their reward is substantially lower than investing and often you can be penalized for withdrawing your money early. They are best suitable for those comfortable with a long time frame.

On the other hand, stocks, bonds, and mutual funds are best for those with a short time frame and more comfortable with risk. They are more profitable and offer the potential for a greater reward. You earn money through interest, appreciation, and what companies pay in dividends. People investing their money may also receive tax relief on income earned through stocks. The biggest drawback though is that there is high risk-high reward when it comes to investing, meaning that it is actually possible to lose money.

Saving

Tips for saving your extra

- You should aim to divide your income 50% for essentials, 30% for lifestyle, and 20% paying debt/savings.

- Large expenses are more manageable when cost is spread out over a larger period of time.

- Save for things such as vacations, weddings, down payments or retirement accounts.

- Savings accounts are set up to be hard to access, so they are allowed to grow over time as passive income.

- Set goals for savings, even if it means starting small.

- Be patient.

- Organize and track spending to know where your money goes.

Creating an Emergency Fund

One overlooked facet of financial fitness is the creation of an emergency fund. Emergency funds are meant to aid/cover us when our finances take an unexpected downturn. Financial stressors such as doctors’ appointments, car repairs and family emergencies can be more manageable with a good sized emergency fund. But it can be difficult to create one when you feel you are living paycheck to paycheck. Here are some helpful tips to jumpstart your emergency fund.

- Set a savings goal. Auto-save a small amount from every paycheck.

- Review your spending habits, especially recurring cost, and consider if there are areas you can cut.

- Sell personal belonging that no longer serve a purpose.

- Put extra cash, such as bonuses, tax returns, and raises into your emergency fund.

- Use cash as much as you can and save the change.

Investing

When beginning to invest, you should be able to answer these few simple questions. What do I plan on doing with the money, when will I need it, how well do I handle risk, and how patient am I? Investing is all about the long game and most won't pay off substantially until 5, 10, even 20 years in the future. You must diversify your portfolio to minimize risk and don't be fickle, stick with your initial investments.

An important aspect in investing is understanding exactly what service or good you are putting your money into. The more informed you are about what stocks you are purchasing, the better decisions you are able to make when buying and selling. Look for any trends and anything predictable in the market or company, especially any red flags. Look at previous prices to see if you are getting a good deal and pay attention to the total cost such as fees, commission, or penalties. A good investor diversifies their portfolio, not just in terms of stocks, but in types of investments. They allocate across different low, medium, and high risk investments allowing them to maximize potential while minimizing risk. It is important you understand exactly what you're investing in. The stock market is unpredictable over the short term, but historically it has produced earnings over the long haul that outpace inflation.

Stocks

When you become a stock owner, you may receive dividends from the companies’ earnings. There is no guarantee that your stocks will increase in value, so it is especially important to diversify your investments.

Bonds

With bonds you are essentially lending your money to a bond issuer, the government or corporation, which they use to issue out loans to people. When you purchase bonds, you are eligible to receive many tax advantages. There is a fixed rate on bond investments meaning there is always a consistent return and most bonds are also financially backed by the government making bonds a very safe investment. But be cautious as buying individual bonds is riskier than investing in a share of a mutual fund.

Mutual

Mutual funds are a large combination of stocks and bonds purchased from a number of different companies. This is done by using money pooled together from many investors. A portfolio manager is in charge of overseeing the choices of investments within the fund, saving you the trouble of researching the investments. The value of the mutual fund may go down if the fund’s holdings go down in value but the opposite is also true. As with any investment strategy, changes in value may result from factors such as fluctuations in the economy or a shift in investor confidence in a particular sector. Like stocks, profits from a mutual fund are not guaranteed. That is why they are better suited for the investor with long-term goals and a lot of patience.