Credit is an essential part of life today. It can be hard to understand the world of credit but here are a few basics you should know. The first thing you should know is that having a credit card doesn't mean that you have free money. You must pay back what you borrow including interest. Failure to do so in a timely manner can result in hardship for the years to come. Irresponsible credit behavior can negatively affect your credit score and can take a long time to recover from. Even if you do not have a credit card, there are other ways you can build your credit score. Loans, such as mortgages and student loans, can help establish credit. Before opening a credit card, you should always talk to a parent or someone that has experience with credit to learn as much as they do.

Don't forget everyone is entitled to check their credit score for free. Visit annualcreditreport.com to download your credit report from Experian, Equifax and TransUnion.

Credit Score

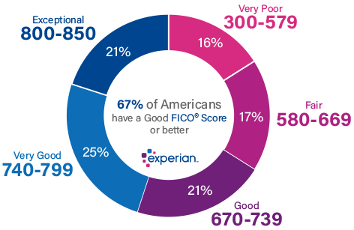

Your credit score is a single number based on your credit history that generalizes your ability to manage credits and pay back debts. Most lenders look at one's credit score to determine their “risk” as a borrower. This is because it is much easier for them to look at one number than have to individually assess each person’s credit reports. Here is a chart on how they rank credit scores.

Helpful tips to build your credit Score:

- Pay your bills on time

- If you can afford to do so, pay more than the minimum amount due

- Try to keep your credit balances low

- Longevity is key. Even if you barely use it, having a line of credit open for a long time shows your reliability as a borrower

Credit Card Debt

Debt is something that goes hand in hand with credit, but you have to understand that a little debt is completely normal. We fall into extensive debt when we make purchases based on emotions as opposed to necessity. When we buy things because we want them and have no solid plans for paying them off, your debts begin to add up. Here are some telltale signs that you may need to reconsider your borrowing behavior:

- You don’t know how much money you actually owe

- Your monthly credit bills, excluding mortgage/rent, are more than 20% of your income

- You have missed multiple payments or only make the minimum payment

- You’ve overdrawn your account at least 3 times in the last year

- You borrow more money to pay off other debts

- You've been rejected by credit cards and debt collectors are calling

Responsibility behind credit

It is important to understand the true cost of owning a credit card and taking out loans. While it may be nice to buy what you want and have it now, you have to decide whether if it is really worth it to you. Even with a small loan, such as $1000, compound interest can add up quickly and you can end up paying significantly more than original loan amount if the loan isn't paid off relatively quickly. You must decide if what you're purchasing is worth it and won't be obsolete or useless to you once you've finally paid it off.

Tips to manage credit cards

- Make sure to pay your credit bills on time and try to pay more than just the minimum payment.

- Avoid applying for multiple cards in a short amount of time. Each time you do, lending companies will look at your credit score, effectively lowering it.

- Always read the terms and conditions and mail sent from the lender as there could be important information that you could miss.

- Decline prescreened/pre-approved cards that are sent in the mail. Find a card that better suits your needs and has better interest rates and benefits.

- Give significant consideration before cosigning for a credit card or loan. It splits responsibility for paying the debt to both parties and you can become liable, or vice versa, if your cosigner fails to make timely payments.

- Only charge what you can afford to pay for in a short amount of time.

- If you intend to make a big purchase, be sure to create a financial plan so that you can pay it off in a timely manner.

- If you do find yourself in a lot of debt, try to minimize your use of credit cards and use cash as much as you can.

- Protect yourself. Identity theft is a real threat. Always shred and destroy any bills or mail with your sensitive information on it. Check your statements and credit reports often. If you have any feeling your card has been stolen or is lost, report it immediately.

Choosing a card

There is a plethora of credit cards out there so it can be hard to figure out which one is right for you. Most lending companies have their own website that helps consumers choose one of their cards, but here are a few resources you can look at that compare cards across multiple credit companies.

https://www.nerdwallet.com/blog/credit-cards/editors-ratings-guesswork-choosing-credit-card/